CL

By Chris Lacagnina

CL

MoneyGeek is dedicated to providing trustworthy information to help you make informed financial decisions. Each article is edited, fact-checked and reviewed by industry professionals to ensure quality and accuracy.

Updated: July 23, 2024

PT

Paul E. Traynor

PT

Assistant Professor of Law at School of Law at University of North Dakota

Paul E. Traynor has spent 29 years as legal counsel and General Counsel for companies that do business across the United States. He received his Juris Doctor degree from the University of North Dakota School of Law in 1988 and a Masters (LLM) of Insurance Laws from the University of Connecticut School of Law in 2002. His professional experience includes advising insurers on regulatory and compliance matters, business development and approval of risk management products. Paul has also represented boards of directors on matters related to mergers & acquisitions, board governance and corporate compliance with securities laws. Further, he has advised insurers both domiciled in the United States and foreign offshore entities that offer risk management products. For the past 10 years, Paul advised insurers specializing in the health care market insuring physician practice groups, major medical centers and teaching hospitals. He has previous professional experience in complex reinsurance transactions and fronting arrangements. As in house counsel, Paul has represented Nodak Insurance Group, Fargo, ND; Horace Mann Companies, Springfield, IL; Kemper Insurance Cos, Chicago, IL; and Coverys, Boston, MA. Currently, Paul is teaching Insurance Law, Health Law, Business Associations and Advanced Torts. He is licensed in Illinois, Michigan, Minnesota and North Dakota and the federal courts of Minnesota and North Dakota.

SW

Steve Wilson

SW

Founder of Bankdash

Steve Wilson is the founder of Bankdash and has worked with banks as a financial analyst. At Bankdash, his team analyzes financial institutions and their customers.

NS

Nick Schrader

NS

Insurance Agent at Texas General Insurance

Nick has been working with insurance companies over the past decade and has seen the changes technology brings in for better or for worse. His objective is to integrate technology with his clients' needs to enhance the customer experience.

RT

Robert L. “Larry” Tucker

RT

Robert L. “Larry” Tucker

Adjunct Professor at the University of Akron

Robert L. "Larry" Tucker is an insurance coverage attorney and law professor. Since 1999, he has held an appointment as an adjunct professor teaching Insurance Law at the University of Akron School of Law. After being awarded his Juris Doctor degree, he went on to earn an LL.M. in Insurance Law at the University of Connecticut. He serves as an arbitrator of the American Arbitration Association, where he is a member of the Commercial Insurance panel and the Complex Coverage Neutral Evaluation panel, both of which are composed of nationally recognized coverage experts, academics, and former judges with insurance law expertise. He is one of just 24 attorneys who are certified by the Ohio State Bar Association as a specialist in Insurance Coverage Law. He also is licensed in Ohio as an insurance agent in the property and casualty, life, and accident and health insurance lines.

TJ

Thomas Scott Jr., JD

TJ

Thomas Scott Jr., JD

Distinguished Visiting Professor of Law, General Counsel at Appalachian School of Law

Mr. Scott is the senior partner at the Street Law Firm, LLP, in Grundy, Virginia, where he has practiced as a criminal and civil litigator for over 46 years. He joined the full-time faculty at the Appalachian School of Law in 2005 and has been selected by his students on multiple occasions as Professor of the Year. Mr. Scott also serves as a faculty advisor to several student organizations, including BLSA, the Republican Law Society, and the Criminal Law Society.

JD

Jeffrey Diamond

JD

Adjunct Professor at Atlanta's John Marshall Law School

Jeffrey D. Diamond, Attorney at Law, is an active member of both the State Bars of Georgia and California, having relocated to Atlanta from Southern California in 2007. He earned his Bachelor of Arts degree from the University of California, Santa Barbara and his Juris Doctor degree from Loyola Law School, Los Angeles. He has more than 41 years of experience as a practicing litigation attorney specializing in Insurance Law and related matters, with extensive experience as both a trial and appellate lawyer. During his career, he has represented both insurance companies and policyholders in insurance coverage and bad faith actions. He has been recognized by Martindale-Hubbell as an “AV” rated attorney, and since 2013, he has been annually recognized as a Georgia Super Lawyer. After having taught Insurance Law for a number of years in California, Mr. Diamond joined the AJMLS faculty in 2012 as an Adjunct Professor of Insurance Law, and since 2009, he has also served as the Adjunct Professor of Insurance Law at Georgia State University College of Law. He is also a law instructor for the National Association of Certified Valuation Analysts, a national educational organization that conducts continuing education programs for financial professionals. Professor Diamond also maintains a full-time law practice in Atlanta, primarily representing policyholders in property, liability, life and disability insurance claims and cases.

CL

By Chris Lacagnina

CL

MoneyGeek is dedicated to providing trustworthy information to help you make informed financial decisions. Each article is edited, fact-checked and reviewed by industry professionals to ensure quality and accuracy.

Updated: July 23, 2024

Advertising & Editorial Disclosure

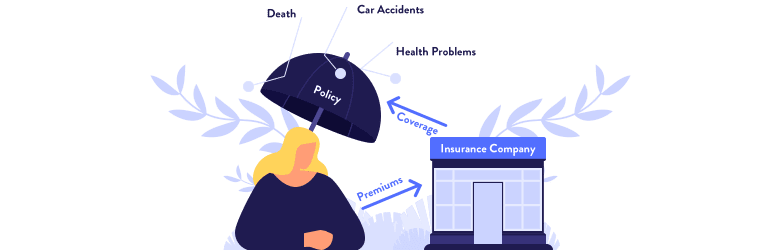

Simply put, the definition of insurance is a contract between an individual (known as the “policyholder”) and an insurance company. In this contract, the insurance company, or carrier, agrees to provide the insured individual (or individuals) named on the policy with a certain amount of financial reimbursement after a covered loss. The insured's reimbursement amount will depend on their policy’s terms, coverage limits and more.

Insurance can help you safeguard your assets in many different areas and help protect your property, family, business and even your reputation. Having an insurance policy can help you recover after what would’ve otherwise been a huge financial loss.

Insurance can allow you to rebuild the destroyed property, replace stolen property, pay for lawsuit costs and much more. Only the disasters or “perils” listed on your insurance policy will be eligible for reimbursement from a claim. Learn more about how insurance works, some key terminology, commonly purchased policies and our experts' insights on what to look for in an insurance company.

When considering if you need insurance, it’s important to consider how much you could stand to lose without a policy to protect your home, car or other assets.

An insurance policy can help you repair or replace stolen, damaged or destroyed property after a covered loss, including disasters like a fire, lightning strike, theft, accident or riot.

Insurance can also help you cover lawsuit costs, such as attorney and court expenses if you get sued by a customer, guest or another third party for a claim of bodily injury or personal property damage.

Without insurance coverage, you risk permanently losing property and your financial assets, including savings, if a large disaster strikes.

Your insurance coverage will be active for as long as your policy is in effect, which is often referred to as the policy term. With your contract’s term, if you endure a loss that’s listed on your policy, you can file a claim with your insurance company to request reimbursement.

For example, the insurance company would investigate your claim if you experienced a fire in your home that destroyed your couch, half of your living room and its contents. The investigation often involves sending an adjuster to visit your property and assess the damage and incident in person. Depending on your insurance company’s decision, you may receive reimbursement for your claim, which could help you replace your couch and other items and get the damage to your living room repaired.

Before being reimbursed, however, you'd first pay your policy's deductible amount — which may be a percentage of the total value of what you're insuring or a specific dollar amount, such as $500 — out of your pocket. You're responsible for covering the deductible for each claim you make.

The reimbursement you receive for a successful claim depends on your policy’s coverage limits. Each category of your coverage, such as property or dwelling, comes with its limit for the maximum amount of reimbursement you can receive after a disaster. If the damage to your property (or other) exceeds your policy's coverage limits, you may have to cover the remainder of the damage out of your pocket.

Insurance comes with a lot of jargon, and understanding its technical language can help you better understand your coverage and what’s included in your policy. Familiarize yourself with the following definitions of standard insurance terms like deductible, premium and exclusions, so you won’t be left scratching your head when reviewing your policy or trying to file a claim.

Insurance Component DescriptionThe premium for your insurance coverage is the amount you pay for your policy, which can be monthly or annually. Your policy’s premium amount is set by the insurance company based on what you’re insuring, how much risk it carries, any discounts you have and more.

The deductible for your insurance coverage is the amount you’re responsible for paying out of your pocket before receiving any reimbursement for a covered loss. Deductibles must be paid on a per-claims basis and can be a set dollar amount or a percentage of your overall coverage.

The conditions section of your policy outlines the requirements you must satisfy to receive coverage for a loss. For example, an insurance policy only covers certain types of losses if the incident is considered "sudden and accidental." If you don't meet your policy's conditions, the carrier may deny your claim.

The exclusions section of your insurance policy outlines what types of disasters and losses aren’t covered by your insurer. For example, home insurance policies typically exclude routine maintenance costs for your home, as insurers consider them the homeowner's responsibility.

The insuring agreement is your insurance company’s outline of promises detailing how they’ll protect you and provide coverage and reimbursement in exchange for you continuing to pay the policy’s premiums on time.

The policy limit is the maximum reimbursement amount your insurance company will pay out after a covered loss. Your policy limits can be different in each coverage category. For instance, you may have a specific coverage limit for your home's contents and a different one for your home's structure.

The primary benefit of insurance is to reduce financial risk. You can buy an insurance policy to mitigate risk in just about any category you can imagine. Here are just a few common forms of insurance and how they benefit the insured.

Example 1: Life Insurance Policy & Financial Benefits for Your Spouse

If you want your spouse to receive an inheritance from your estate to help pay for their living expenses after you pass, you can arrange for a life insurance policy to make them your beneficiary and receive the death benefit. Additionally, you can arrange for your life insurance to set money aside for children (or other dependents) or to donate to a charity in your name after you pass.

Example 2: Car Insurance & Getting Financial Reimbursement

With collision car insurance, you can receive financial reimbursement from your car insurance company for the physical damage to your vehicle after an accident. Bodily injury liability car insurance can reimburse for injuries you cause to others in an accident or otherwise with your car. Property damage liability coverage can reimburse for damage to others' property, such as fences or mailboxes, that you inflict with your vehicle. You'll have to pay your deductible amount out of pocket before receiving reimbursement for a claim.

Example 3: Home Insurance & Reimbursements for Repairs & Damaged Personal Property

After a covered disaster like vandalism or a fire, your home insurance can provide reimbursement for the repair or rebuilding of your home’s structure as well as the replacement of any damaged or destroyed personal property within the home (known as “contents”), up to your policy’s limits in each category. You’ll have to pay your deductible amount out of pocket before receiving reimbursement for a claim.

Example 4: Health Insurance & Covering Expenses

If you get sick and need to go to the doctor, your health insurance can help cover part or all of the expenses from your visit and often part or all of any medications. Your health insurance policy's terms will determine if your coverage pays for a certain percentage of your expenses or a specific dollar amount. If your health insurance comes with a deductible, you’ll have to meet this amount out of your pocket before receiving any reimbursement.

Though insurance is available for almost anything under the sun, certain types of coverage are more popular than others. Common areas where people buy insurance are for their homes or other property, cars, special vehicles, assets (life), health and medical expenses and pets. Here's a quick look at how some of the most common types of insurance function and who benefits from them.

Home insurance offers reimbursement after damage to your property. This coverage is purchased by folks who own their homes outright. Home insurance covers many threats to your home and personal property, such as fire damage, lightning strikes, vandalism, falling objects, snow damage, certain types of water damage and much more. Home insurance typically covers your home’s structure (also called the “dwelling”), your personal property like clothing and electronics, your personal liability if you injure a third party or damage a third party’s property and additional living expenses if you must stay at a hotel or other temporary residence while your home is under repair for a covered disaster. This coverage is often made mandatory by mortgage lenders.

Car insurance offers reimbursement for accidents or other types of vehicle-related incidents, depending on the types of coverage you select. At least some car insurance is required in every state, but the exact required coverages vary by location. Anyone who owns a vehicle is required by state law to at least buy the minimum mandatory coverage. This can include property damage liability, bodily injury liability, uninsured motorist coverage (that covers your losses if you get into an accident with an uninsured driver), personal injury protection (that covers your injuries or injuries to your passengers in an accident that you caused) and more. Car insurance can protect your vehicle against physical damage and protect you against lawsuits if you cause an accident or injure someone else with your car.

Motorcycle insurance works very similarly to car insurance. However, the minimum motorcycle insurance coverage required in most states is only liability: bodily injury liability and property damage liability. Other forms of coverage, such as collision and comprehensive, are often optional. Comprehensive coverage for motorcycles, similar to how it operates under car insurance, can protect your motorcycle against threats other than collision, including fire damage, theft and vandalism. No matter where you live, motorcycle insurance is often mandatory for all who own a motorcycle.

Life insurance provides a payout (known as the “death benefit”) to a chosen person (known as the “beneficiary”) at the time of your death. This coverage is purchased by a wide range of folks, including adults who want to protect the financial future of their spouse or dependents. However, even those without dependents may purchase life insurance to be able to donate to a charity or other organization after they pass. Life insurance is also commonly purchased to cover end-of-life expenses, such as funeral costs or remaining mortgage. This coverage is optional and not required by law.

Health insurance provides reimbursement for medical expenses, including doctor visits, prescription medications and other covered expenses. A few select states currently require health insurance by law, including California, Massachusetts, New Jersey, Rhode Island, Vermont and Washington D.C. Folks in these areas may face state penalties if they don’t purchase health insurance (excluding Vermont). Still, coverage is no longer mandatory at a federal level. Many individuals purchase health insurance, including those who require frequent doctor or hospital visits, have ongoing medical expenses, and need expensive prescriptions or regular procedures.

Renters insurance provides similar protection to home insurance, but policies are designed for and purchased by folks who rent their homes. Renters insurance covers many of the same disasters home insurance does, including fire damage, vandalism, theft and lawsuits against you for bodily injury or personal property damage to others. In contrast to home insurance, renters insurance focuses on protecting your personal property since you don't own your home's dwelling. This coverage is often made mandatory by the company you rent the apartment or house from before your lease can be approved.

Pet insurance operates similarly to how health insurance works for humans and is often purchased by folks who have pets that may require frequent, expensive veterinary trips or medications. Coverage is available at three different levels, and basic coverage can protect against accidental injuries, poisonings and sickness. Comprehensive pet insurance provides more in-depth coverage for emergencies, vet office visits, tests, X-rays and prescription medications. Pet Well Care protection is also available and includes reimbursement for preventive care like flea and heartworm treatments and vaccinations. Pet insurance is optional and not a required type of coverage.

Insurance is a vital asset for many folks who want to adequately protect their property, health, vehicles, pets or other aspects of their lives. But insurance also comes with specific jargon and concepts that many individuals may find confusing at first. MoneyGeek answered some of the most common insurance questions below to help clarify this important topic.

Can I get multiple insurances for the same thing?Yes, you can often have more than one insurance policy for the same thing to provide additional coverage if you wish. However, you cannot file the same claim under each policy, which would be insurance fraud. Note that you must check with your first policy’s terms to ensure that having a second insurance policy from another carrier will not violate your contract.

What is an insurance premium?An insurance premium is an amount you pay for your policy, which may be monthly or annually, depending on your choice. The insurance company sets your policy’s premium amount based on what you’re insuring, how much risk it carries and any discounts you have, among others.

How much is insurance?How much your insurance policy costs depends on many factors dictated by the type of coverage. For example, your home insurance costs will be influenced by the value of your home, your location, how much coverage you need and other factors.

What is term life insurance?Term life insurance is a type of life insurance designed to only cover you for a set period of time, such as 5, 10 or 20 years. Term life policies are often purchased by younger individuals who are healthy and don’t necessarily “need” coverage but want to take advantage of the policy's affordability.

What is mortgage insurance?Mortgage insurance is a policy designed to protect the mortgage lender if the borrower defaults on their loan. Mortgage lenders often require this type of coverage if a home buyer purchases a residence with a down payment of less than 20% of the property's value.

How much is car insurance?The cost of car insurance depends on many factors, including your location, the coverages you select, any discounts you may qualify for, your credit score and history, your age, the value of your vehicle and more. The current national average rate for car insurance is $1,424 annually or about $119 per month.

What is comprehensive insurance?Comprehensive insurance is an optional coverage under auto insurance that protects against threats “other than collision,” including fire damage, theft, windshield breakage, accidents with large animals like deer and more. This coverage is most often optional.

MoneyGeek spoke with industry leaders and academics to provide insight on insurance and what to look for when selecting your coverage and carrier. By reviewing their answers, you can learn more about what's important in an insurance policy and company.

Thomas Scott Jr., JD Distinguished Visiting Professor of Law, General Counsel at Appalachian School of Law READ ANSWERS

Robert L. “Larry” Tucker Adjunct Professor at the University of Akron READ ANSWERSPaul E. Traynor Assistant Professor of Law at School of Law at University of North Dakota READ ANSWERS