Along with already existing owner’s equity, new loans help businesses fund acquisitions, expand operations, buy assets, invest, refinance debt, and boost working capital. As a result, when borrowed money is repaid, the firm usually pays some sort of interest on top of the principal. This is recorded with the help of a journal entry for interest paid on loan.

A loan is an external liability for the business. It can be a long-term or short-term obligation. A short-term loan has to be paid back within 12 months. On the other hand, a long-term loan has a longer tenure.

Interest on a loan is an expense for the business. Payments are typically made to the lender periodically, such as monthly, quarterly, semi-annually, or annually along with the repayment of the principal.

The Journal entry for Interest paid on loan is as follows;

| Interest on Loan A/c | Debit |

| To Bank A/c | Credit |

(Being interest paid on loan)

Accounting Rules applied – “Interest on Loan A/c” is debited as Dr. the increase in expense. “Bank A/c” is credited as Cr. the decrease in assets (bank balance).

3 Golden Rules applied – “Interest on Loan A/c” is a nominal account therefore Dr. all expenses and losses. “Bank A/c” is a personal account therefore Cr. the giver.

Here is an example to help you understand the above journal entry;

XYZ Ltd. has taken a loan of 25,000 from HSBC Bank. The bank charges an interest of 10% per annum on the loan. Pass the necessary journal entry to record the interest expense incurred at the time of payment.

For the above transaction, the following journal entry would be recorded (annual);

| Interest on Loan A/ c | 2,500 |

| To HSBC Bank A/c | 2,500 |

(Being interest paid to HSBC bank on loan)

Percentage of interest p.a. x Amount of loan = 10% of 25,000 = 2,500

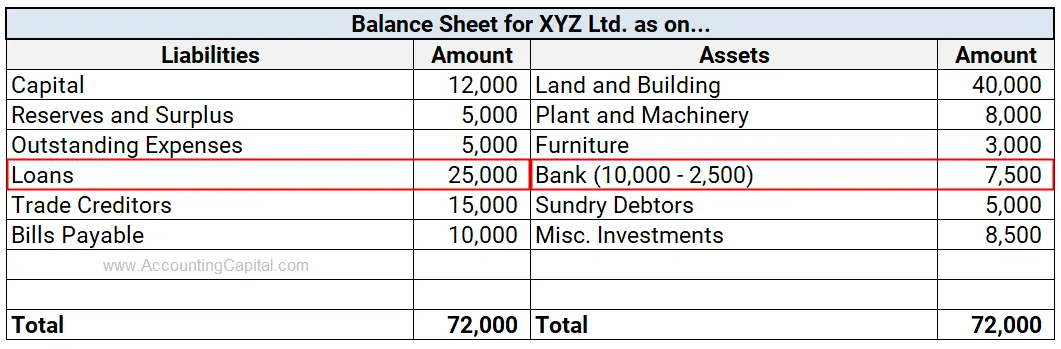

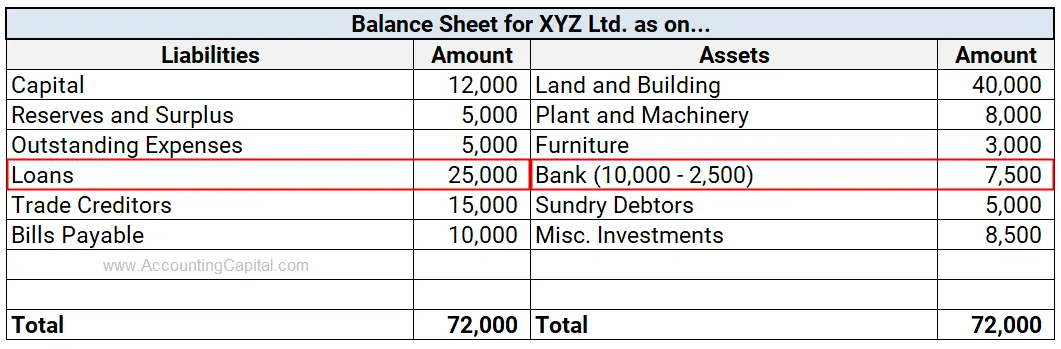

Balance Sheet: the reduced bank balance would be shown under the “Current Assets” head of the Assets side.

A loan is a liability for the business. Hence, it is shown on the liabilities side of the Balance Sheet. When the loan is repaid, the balance is reduced accordingly.

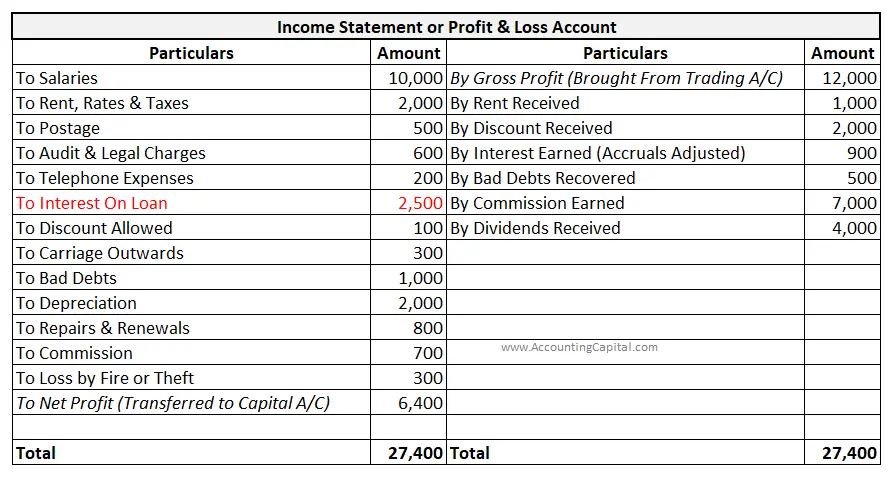

Profit and Loss Account: Interest on the loan is shown on the debit side as it is an expense for the business. Payment of interest reduces the net profit & net income of the business.

In accounting, interest expense is treated as a cost of borrowing. It is the cost of using external funds to finance business operations.

Trading account: No impact.

Cash Flow Statement: Interest on the loan is shown under “Financing Activities”. It is an outflow of cash as the bank balance is reduced by the payment. Bank balance is a form of cash and cash equivalents.

From the above discussion, we can conclude that: