Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

In accounting, confusion sometimes arises when working between accounts payable vs accounts receivable. The two types of accounts are very similar in the way they are recorded, but it is important to differentiate between accounts payable vs accounts receivable because one of them is an asset account and the other is a liability account. Mixing the two up can result in a lack of balance in your accounting equation, which carries over into your basic financial statements.

It is important to note the significance of balancing your assets and liabilities and stockholders’ equity in accounting. The significance of the balance can be explained by the basic accounting equation: Assets = Liabilities + Stockholders’ Equity. One can also rearrange the equation to better suit their preferences.

Accounts payable is a current liability account that keeps track of money that you owe to any third party. The third parties can be banks, companies, or even someone who you borrowed money from. One common example of accounts payable are purchases made for goods or services from other companies. Depending on the terms for repayment, the amounts are typically due immediately or within a short period of time.

Accounts receivable is a current asset account that keeps track of money that third parties owe to you. Again, these third parties can be banks, companies, or even people who borrowed money from you. One common example is the amount owed to you for goods sold or services your company provides to generate revenue.

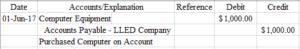

In business transactions, companies will often purchase items on account (not for cash). The term used to call the transactions is purchases “on account,” which signifies a transaction where cash is not involved. The best way to illustrate this is through an example.

On June 1, 2017, Corporate Finance Institute purchased $1,000 worth of computer equipment on account from LED Company. It means our asset account, computer equipment, increased and our liability account, accounts payable, also increased by $1,000. Below is what it would look like in a journal entry:

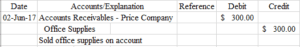

On the other hand, there are times when a company will sell goods or services “on account.” Again, it means that there is a transaction occurring where cash is not involved. Here is another example to help illustrate what this might look like.

On June 2, 2017, Corporate Finance Institute sold $300 worth of office supplies on account to Price Company. In the transaction, our accounts receivables increased by $300 and our office supplies account decreased by $300. This is what it would look like in a journal entry:

Another important note to make is that sometimes companies will attach discounts to their account receivable accounts to incentivize the borrower to pay back the amount earlier. The discounts benefit both parties because the borrower receives their discount while the company receives their cash repayment sooner, as companies require cash for their operating activities.

Here are two notations that are commonly used:

For the first notation, we read it as an “x” percentage discount if the amount is paid back or received within 10 days. Some companies may choose to even give a discount if the amount is paid back or received within 20 days. Here is what an example of a 4% discount, if paid back within 15 days, would look like: 4/15.

The second notation, usually used after the discount notation, means the net amount must be paid within 30 days or how many days you decide. A perfect way to demonstrate what this would mean is to show an example.

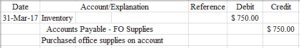

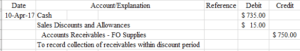

On March 31, 2017, Corporate Finance Institute decided to purchase $750 worth of inventory on account from FO Supplies. The terms of this transaction were 2/10, n/30. This is what it would look like in the journal entry:

This is what the initial purchase of inventory would look like in the journal entry. We excluded the terms in the description portion of our journal entry because it is optional. It is up to the individual whether or not they wish to include the terms of the transaction.

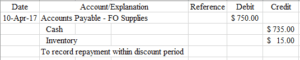

The next part is recording the discount if the account is paid back within the discount period. In order to determine the discount, we need to take the $750 and multiply by 0.02 (2%). This is what it would look like in your journal entry:

Notice that we record the discount directly against inventory. This is because we are recognizing that we paid less for the inventory that we received. This is to prevent overstatement or understatement of the inventory amount at the end of the fiscal year in our financial statements, especially the balance sheet.

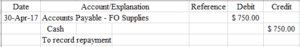

What happens if we do not pay it back within the discount period? Well, that’s simple, we simply record it as a regular repayment of accounts payable:

Although this example focused mainly on accounts payable, you can also do this with accounts receivables as well and we can demonstrate that with this next example.

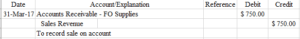

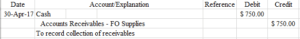

Here we will use the same example as above but instead, Corporate Finance Institute sells $750 worth of inventory to FO Supplies. The terms are still the same, at 2/10, n/30.

This is the first entry that an accountant would record to identify a sale on account. Afterward, if the receivables are paid back within the discount period, we need to record the discount.

Notice that we have an account called sales discounts and allowances. This account is a contra account that goes against sales revenue on the income statement. Another example of a contra account is allowance for doubtful accounts, which you can learn about in our bad debt expense article.

Lastly, if the receivables are paid back after the discount period, we record it as a regular collection of receivables.

We hope that this gave you a pretty good idea of the differences between accounts payable vs accounts receivable. Hopefully, it also gave you some insight into some of the many things that we can do with these accounts, such as discounts. If you are interested in learning more, be sure to check out these related CFI articles:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.