Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

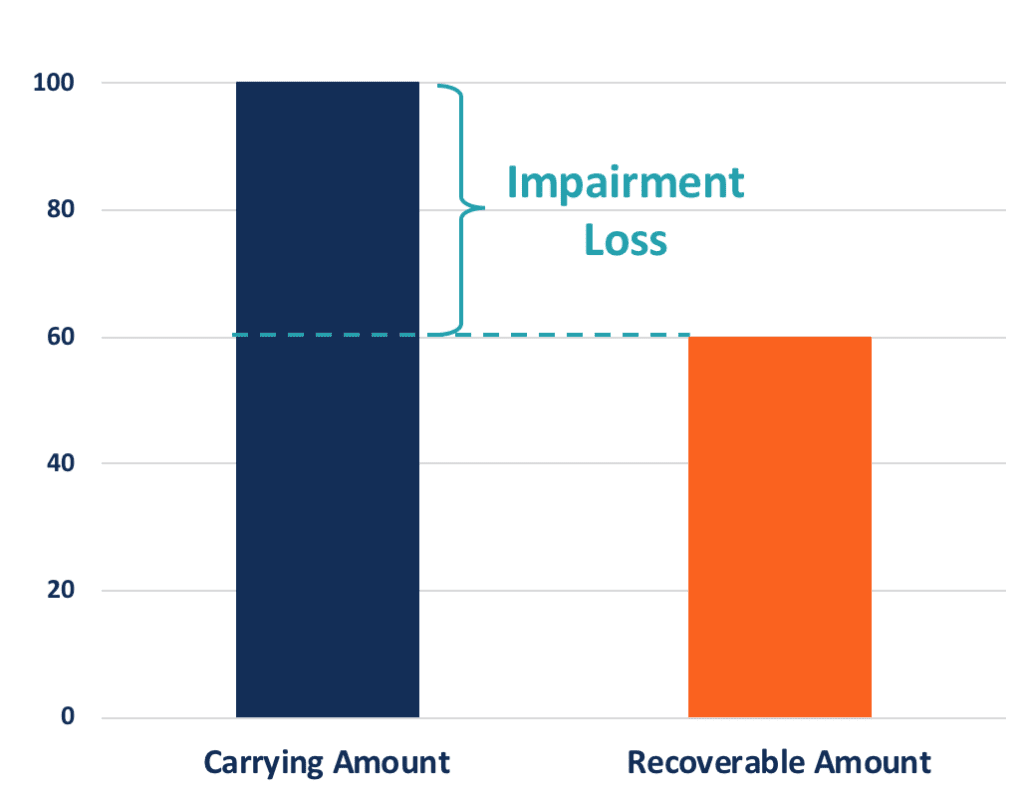

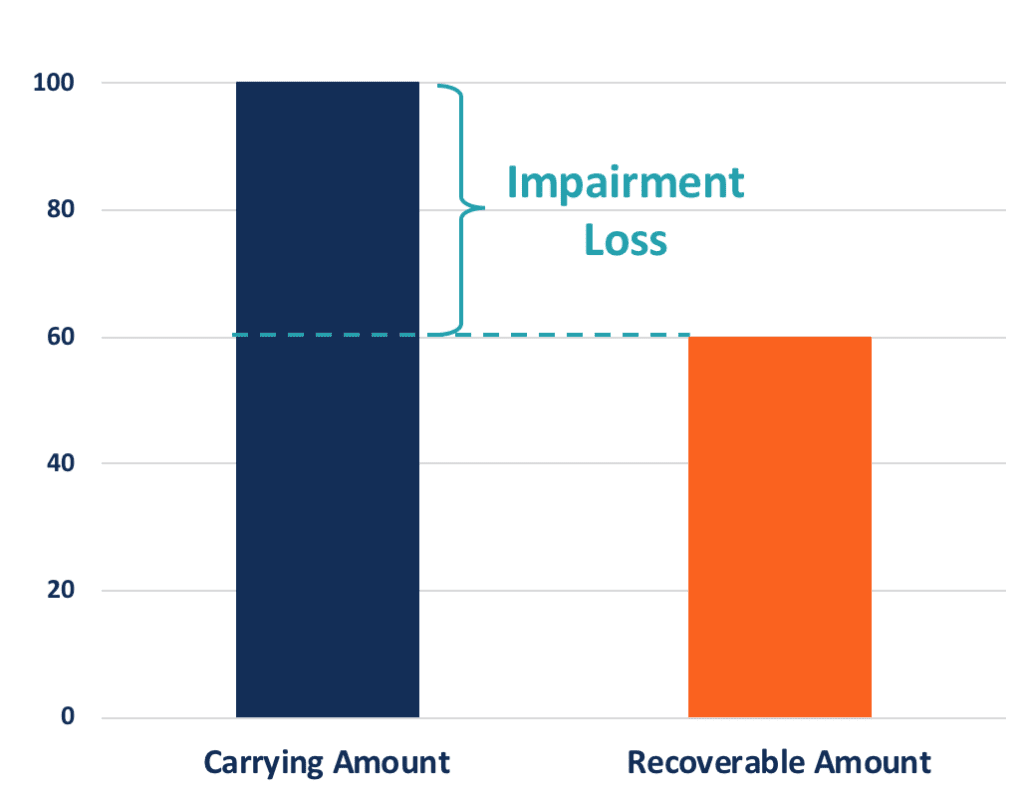

An impaired asset is an accounting term that describes an asset with a recoverable value or fair market value that is lower than its carrying value. When an asset is impaired, a write-down on the balance sheet and an impairment loss are recognized on the income statement. IFRS and GAAP impose different rules on impaired assets.

Long-term assets, including fixed (e.g., PP&E) and intangible (e.g., patents, licenses, goodwill) assets, are subject to asset impairment as a result of their long economic lives. A long-term asset is typically reported at its historical cost on the balance sheet and then depreciated or amortized over time. The practice leads to a potential for the discrepancy between the reported value on the balance sheet, which is known as the carrying value, and the fair value of the asset.

If the market value of an asset is lower than the carrying value, the asset is impaired and must be reduced to its fair market value, and the amount of the write-down will be reported as a loss. This often occurs when the asset is depreciated or amortized at an underestimated amount or following a decline in the asset’s market value.

For example, a food company purchased a packaging machine at $100,000 two years ago and depreciates it at $5,000 every year. The carrying value is thus $90,000 (100,000 – 2*5,000) in the current year. If the same type of two-year-old machine is priced at $80,000 in the market, the packaging machine will be reported as an impaired asset with its book value lowered to $80,000. The $10,000 write-down will be reported as an impairment loss on the company’s income statement .

The asset impairment practice ensures that assets are reported on the balance sheet at their fair market value. The practice better reflects the financial picture of a company’s assets for users of the financial statements.

Asset impairment can also smoothen the loss of sales when the asset is disposed of. If an asset is continually depreciated at an underestimated amount, the asset will be reported at a book value that is higher than its market value, and this gap expands overtime.

When the asset is sold at the market value after several years, the company will realize a large loss. Instead, if the company records impairments periodically, the book value of the asset will better align with the market value, and the large loss will instead be recognized over several impairment losses.

Whether an asset should be impaired and how much should be impaired is determined by the accounting rules. IFRS and US GAAP apply different rules to impaired assets.

IFRS implements a one-step approach to identify and report impaired assets. An impairment loss occurs when the carrying amount of an asset is greater than its recoverable amount. The recoverable amount is either the market value less the selling cost or the value in use (the present value of all the future cash flows that the asset is expected to generate), whichever is larger.

For example, assume an asset is expected to create $10,000 cash income per year for the next three years at a discount rate of 2%, so its value in use is $28,839 in the current year. If the asset can be sold at $30,000 with zero selling cost, the recoverable amount will be $30,000. With a carrying amount of $38,000, the asset will be written down by $8,000, and an equal amount of impairment loss will be recognized.

If an asset’s been impaired, but the recoverable amount goes up above the carrying value in a later year, IFRS allows for impairment recovery. However, the recovery amount is limited to the cumulative recognized impairment losses, which means companies are not allowed to expand their balance sheets by matching the carrying amounts to higher market values.

US GAAP implements a two-step approach. The first step is a recoverability test to determine whether an asset should be impaired. When the book value of an asset is greater than the undiscounted cash flows that the asset is expected to generate, the book value is considered non-recoverable, and an asset impairment should be recognized.

The second step measures the impairment loss after passing the step one test. The write-down amount is equal to the difference between the asset book value and fair value (or the sum of discounted future cash flows if the fair value is unknown).

Using the same example above, the sum of undiscounted future cash flows is $30,000, which is lower than the carrying amount of $38,000. Thus, the recoverability test is passed, and the asset should be impaired. According to the second step, the impairment loss will be $8,000 ($38,000 – $30,000). If the fair market value is unknown, the impairment loss will be $9,161 ($38,000 – $28,839).

While calculating asset impairment under GAAP, it is important to be aware that undiscounted cash flows are used in the first step, while discounted cash flows are used in the second step. Another difference between the GAAP and IFRS policies is that GAAP does not allow recovery of impairment.

CFI offers the Financial Modeling & Valuation Analyst (FMVA®) certification program for those looking to take their careers to the next level. To keep learning and advance your career, the following resources will be helpful:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.